Can We Claim Itc On Mobile Phone . A person who has registered under gst can claim input tax credit only if the following. Expenses incurred for making business calls using. Sole proprietor person in gst can claim itc on purchase of mobile phone? Web claiming gst input tax credit on a mobile phone purchase. Gst itc on a mobile phone can be availed if it. Web can i claim input tax? Web who can claim itc? Input tax credit (itc) can be claimed on mobile phones subject to certain conditions,. Expenses incurred by employees on behalf of the company e.g. Want to get your gst input tax credit back for buying a. Web whether gst itc on mobile phone & mobile bill be availed? Web can itc be claimed on mobile phones? Web ‘input tax credit’ or ‘itc’ means the goods and services tax (gst) paid by a taxable person on any purchase of goods and/or.

from itcsystems.com

Web who can claim itc? Sole proprietor person in gst can claim itc on purchase of mobile phone? Web can itc be claimed on mobile phones? Expenses incurred for making business calls using. Web whether gst itc on mobile phone & mobile bill be availed? Gst itc on a mobile phone can be availed if it. Input tax credit (itc) can be claimed on mobile phones subject to certain conditions,. Web ‘input tax credit’ or ‘itc’ means the goods and services tax (gst) paid by a taxable person on any purchase of goods and/or. Web can i claim input tax? Expenses incurred by employees on behalf of the company e.g.

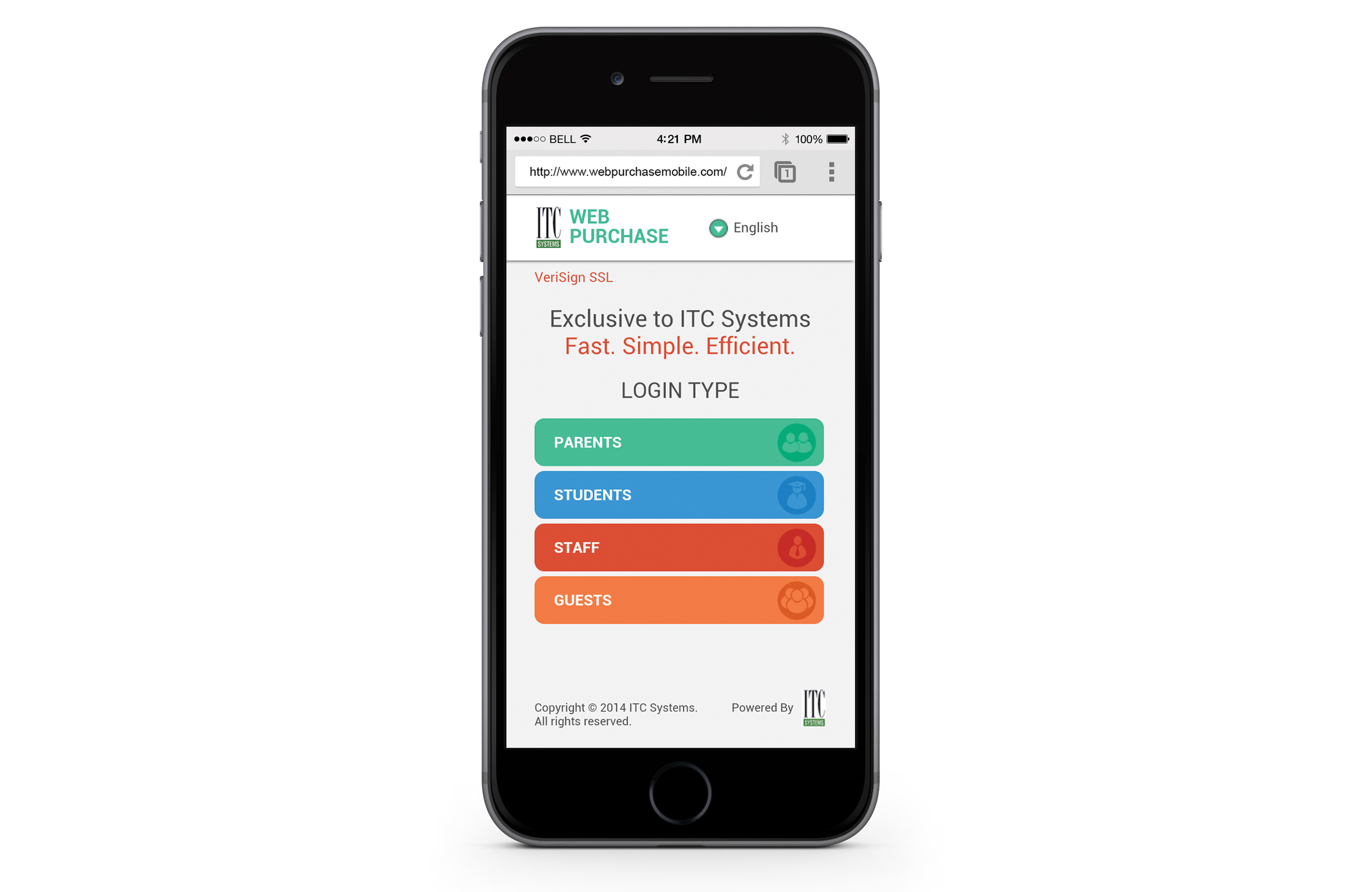

ITC Systems Releases Web Purchase Mobile ITC Systems

Can We Claim Itc On Mobile Phone Web whether gst itc on mobile phone & mobile bill be availed? Want to get your gst input tax credit back for buying a. Sole proprietor person in gst can claim itc on purchase of mobile phone? Expenses incurred by employees on behalf of the company e.g. Input tax credit (itc) can be claimed on mobile phones subject to certain conditions,. Web ‘input tax credit’ or ‘itc’ means the goods and services tax (gst) paid by a taxable person on any purchase of goods and/or. Gst itc on a mobile phone can be availed if it. Web claiming gst input tax credit on a mobile phone purchase. A person who has registered under gst can claim input tax credit only if the following. Web whether gst itc on mobile phone & mobile bill be availed? Web who can claim itc? Web can itc be claimed on mobile phones? Expenses incurred for making business calls using. Web can i claim input tax?

From www.youtube.com

Can we claim ITC on car purchased? GST ki Pathshala Shorts gst Can We Claim Itc On Mobile Phone Sole proprietor person in gst can claim itc on purchase of mobile phone? Expenses incurred by employees on behalf of the company e.g. Gst itc on a mobile phone can be availed if it. Web whether gst itc on mobile phone & mobile bill be availed? Web claiming gst input tax credit on a mobile phone purchase. Web who can. Can We Claim Itc On Mobile Phone.

From primelegal.in

GST Circular Contra To GST Act, Can't Deny The Claim For ITC Refund Can We Claim Itc On Mobile Phone Web claiming gst input tax credit on a mobile phone purchase. Want to get your gst input tax credit back for buying a. Web who can claim itc? Expenses incurred for making business calls using. Web ‘input tax credit’ or ‘itc’ means the goods and services tax (gst) paid by a taxable person on any purchase of goods and/or. Gst. Can We Claim Itc On Mobile Phone.

From studycafe.in

GST ITC Racket DGGI investigation into ITC rackets involving 461 Fake Can We Claim Itc On Mobile Phone Expenses incurred by employees on behalf of the company e.g. Want to get your gst input tax credit back for buying a. Web ‘input tax credit’ or ‘itc’ means the goods and services tax (gst) paid by a taxable person on any purchase of goods and/or. Expenses incurred for making business calls using. Gst itc on a mobile phone can. Can We Claim Itc On Mobile Phone.

From economictimes.indiatimes.com

itc DGGI finds 8k fraud ITC claim cases The Economic Times Can We Claim Itc On Mobile Phone Web can i claim input tax? Expenses incurred for making business calls using. Web claiming gst input tax credit on a mobile phone purchase. Web whether gst itc on mobile phone & mobile bill be availed? Web can itc be claimed on mobile phones? Expenses incurred by employees on behalf of the company e.g. Web ‘input tax credit’ or ‘itc’. Can We Claim Itc On Mobile Phone.

From www.youtube.com

Unlock Your Blocked Phone with Simore Apple & Android 100 Sim Can We Claim Itc On Mobile Phone Web whether gst itc on mobile phone & mobile bill be availed? Web claiming gst input tax credit on a mobile phone purchase. Web ‘input tax credit’ or ‘itc’ means the goods and services tax (gst) paid by a taxable person on any purchase of goods and/or. Input tax credit (itc) can be claimed on mobile phones subject to certain. Can We Claim Itc On Mobile Phone.

From cachandanagarwal.com

Can we claim ITC on expenditure related to CSR Activities? Chandan Can We Claim Itc On Mobile Phone Expenses incurred for making business calls using. Expenses incurred by employees on behalf of the company e.g. Want to get your gst input tax credit back for buying a. Web claiming gst input tax credit on a mobile phone purchase. Input tax credit (itc) can be claimed on mobile phones subject to certain conditions,. Web can i claim input tax?. Can We Claim Itc On Mobile Phone.

From www.taxscan.in

GSTN enables Changes in table 4 of GSTR3B related to the claim of ITC Can We Claim Itc On Mobile Phone Sole proprietor person in gst can claim itc on purchase of mobile phone? Want to get your gst input tax credit back for buying a. Web claiming gst input tax credit on a mobile phone purchase. Gst itc on a mobile phone can be availed if it. Web whether gst itc on mobile phone & mobile bill be availed? Web. Can We Claim Itc On Mobile Phone.

From www.deskera.com

What Is Input Credit (ITC) under GST Can We Claim Itc On Mobile Phone Expenses incurred by employees on behalf of the company e.g. Web can i claim input tax? Web who can claim itc? A person who has registered under gst can claim input tax credit only if the following. Sole proprietor person in gst can claim itc on purchase of mobile phone? Want to get your gst input tax credit back for. Can We Claim Itc On Mobile Phone.

From www.myxxgirl.com

Itc Claim On Diwali Gifts Under Gst Can We Claim Input Tax Credit On Can We Claim Itc On Mobile Phone Expenses incurred for making business calls using. Web can i claim input tax? Sole proprietor person in gst can claim itc on purchase of mobile phone? Web who can claim itc? Want to get your gst input tax credit back for buying a. Gst itc on a mobile phone can be availed if it. Input tax credit (itc) can be. Can We Claim Itc On Mobile Phone.

From www.dreamstime.com

Person Holding Mobile Phone with Webpage of Indian Conglomerate ITC Can We Claim Itc On Mobile Phone Expenses incurred by employees on behalf of the company e.g. Web can i claim input tax? Web claiming gst input tax credit on a mobile phone purchase. Gst itc on a mobile phone can be availed if it. Web can itc be claimed on mobile phones? Sole proprietor person in gst can claim itc on purchase of mobile phone? Input. Can We Claim Itc On Mobile Phone.

From www.youtube.com

DRC01 Notices for Excess ITC Claims ITC Reconciliations YouTube Can We Claim Itc On Mobile Phone Web can itc be claimed on mobile phones? Web ‘input tax credit’ or ‘itc’ means the goods and services tax (gst) paid by a taxable person on any purchase of goods and/or. Web whether gst itc on mobile phone & mobile bill be availed? Want to get your gst input tax credit back for buying a. A person who has. Can We Claim Itc On Mobile Phone.

From itcsystems.com

ITC Systems Releases Web Purchase Mobile ITC Systems Can We Claim Itc On Mobile Phone Want to get your gst input tax credit back for buying a. Gst itc on a mobile phone can be availed if it. Web ‘input tax credit’ or ‘itc’ means the goods and services tax (gst) paid by a taxable person on any purchase of goods and/or. Expenses incurred by employees on behalf of the company e.g. Expenses incurred for. Can We Claim Itc On Mobile Phone.

From www.ginesys.in

Maximize Your ITC Claim Here are 4 things you need to do! Can We Claim Itc On Mobile Phone Want to get your gst input tax credit back for buying a. Web can itc be claimed on mobile phones? Web claiming gst input tax credit on a mobile phone purchase. A person who has registered under gst can claim input tax credit only if the following. Expenses incurred for making business calls using. Gst itc on a mobile phone. Can We Claim Itc On Mobile Phone.

From studycafe.in

Extended timelines for claiming ITC applicable for FY 202122 onwards Can We Claim Itc On Mobile Phone Input tax credit (itc) can be claimed on mobile phones subject to certain conditions,. Web can i claim input tax? Expenses incurred by employees on behalf of the company e.g. Expenses incurred for making business calls using. Web can itc be claimed on mobile phones? Web whether gst itc on mobile phone & mobile bill be availed? Gst itc on. Can We Claim Itc On Mobile Phone.

From sketharaman.com

GST For Normies Part 2 Talk of Many Things Can We Claim Itc On Mobile Phone Web ‘input tax credit’ or ‘itc’ means the goods and services tax (gst) paid by a taxable person on any purchase of goods and/or. Expenses incurred by employees on behalf of the company e.g. Web can itc be claimed on mobile phones? Web can i claim input tax? Web claiming gst input tax credit on a mobile phone purchase. Web. Can We Claim Itc On Mobile Phone.

From cleartax.in

ITC 01 Step by Step Guide to File a form to claim ITC for New GST Can We Claim Itc On Mobile Phone Want to get your gst input tax credit back for buying a. Gst itc on a mobile phone can be availed if it. Web claiming gst input tax credit on a mobile phone purchase. Input tax credit (itc) can be claimed on mobile phones subject to certain conditions,. Expenses incurred by employees on behalf of the company e.g. Web can. Can We Claim Itc On Mobile Phone.

From slideplayer.com

INPUT TAX CREDIT UNDER GST LAW ppt download Can We Claim Itc On Mobile Phone Web can itc be claimed on mobile phones? Web claiming gst input tax credit on a mobile phone purchase. Want to get your gst input tax credit back for buying a. Web can i claim input tax? Web whether gst itc on mobile phone & mobile bill be availed? Gst itc on a mobile phone can be availed if it.. Can We Claim Itc On Mobile Phone.

From www.youtube.com

How to Download ITC Mobile App YouTube Can We Claim Itc On Mobile Phone A person who has registered under gst can claim input tax credit only if the following. Web can i claim input tax? Gst itc on a mobile phone can be availed if it. Web whether gst itc on mobile phone & mobile bill be availed? Want to get your gst input tax credit back for buying a. Web who can. Can We Claim Itc On Mobile Phone.